Generally, Investment Banks play a vital role in simplifying financial transactions. They offer guidance on determining a company's value and devising effective strategies for deals such as acquisitions, mergers or takeovers.

Their services encompass various aspects, including assisting in the issuance of new debt and equity securities for different types of companies, supporting the sale of securities and facilitating activities like mergers, acquisitions, reorganizations and brokerage trades for both institutional and private investors.

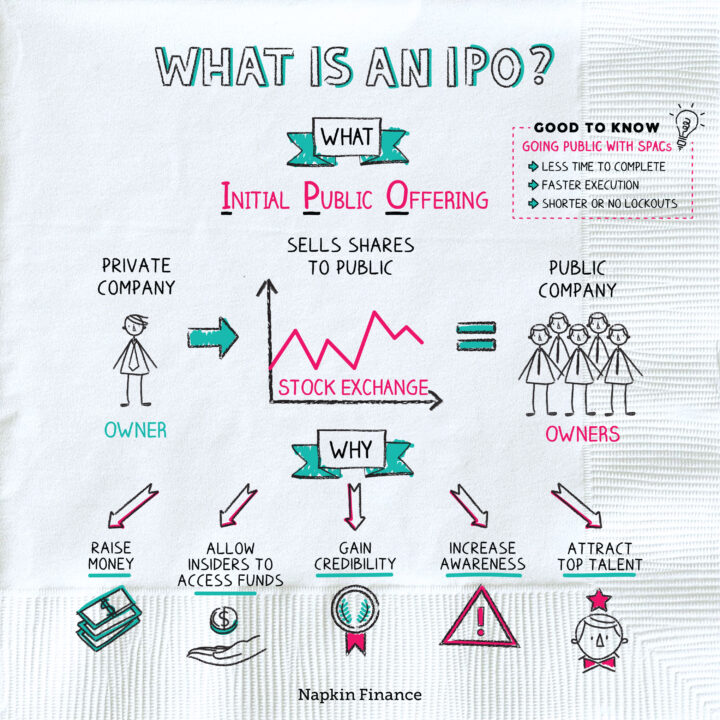

In an Initial Public Offering (IPO), an investment bank mainly acts as a middleman between the investors and the issuer. It enables the clients, i.e., the companies to raise money. IPO is a way of offering shares of a private company to the public in a new stock offering. This allows a company to raise capital from public investors.

Companies hire investment bankers when they plan a new stock issuance for the public for various functions like underwriting, due diligence, marketing and a smooth issuance process. The role of investment banks is crucial for the success of an IPO.

How do investment banks help in an IPO?

How do investment banks help in an IPO?

Let us discuss the roles and responsibilities of Investment Banks in an IPO in detail to gain a better understanding: -

Pricing and Valuation of Shares

Determining the appropriate price for an IPO is an important aspect. Investment banks play a crucial role in this as they carefully consider both maximizing the funds raised for their client company and attracting a significant number of investors.

If the stock is priced too high, it may fail to attract sufficient investor interest, while pricing it too low may result in inadequate funds raised. Investment bankers assist the management and promoters of the company in establishing a fair price for the new offering and strive to arrive at a fair valuation of the shares to be issued.

Role after Roadshows

Roadshows are an important marketing strategy when a company comes with a new public offering. They help in creating a buzz and sentiment among the public and create awareness about the IPO of the company. Investment banks take the lead in roadshows and propagate the information about the public issue and necessary details, thereby generating more subscribers to the issue.

Underwriting

One of the most important roles of an investment bank is that of an underwriter. So, let us first understand the meaning of underwriting. Underwriting refers to a process which involves evaluating the risk and price of a particular security. Investment banks first buy or underwrite the securities of the issuing entity and then sell them in the market.

Thus, investment banks underwrite shares for companies that come with a new public offering. It is also general for companies to engage many investment banks to underwrite a new public offering, whereby one company acts as a lead underwriter, mainly subjective to the size of the IPO.

Sale during the lock-up period

Investment bankers initiate the sale of shares to the general public on the day of the IPO to generate profits and boost the company's market worth. Moreover, banks impose lock-up periods on newly issued stocks, usually lasting six months, which prevent early IPO investors from selling their shares before this period.

The purpose of this is to create greater demand for the stock and prevent a large-scale sell-off that could cause a significant decline in the company's stock prices. This is mainly facilitated by investment banks.

Distribution Expertise

An important function of investment banks is to purchase shares from the issuing company and subsequently sell them to institutional investors. Therefore, when companies choose an investment bank, it is crucial to assess the strength of their distribution expertise and ensure that the selected bank can assemble a robust syndicate that offers an appropriate and effective distribution channel for your company.

When hiring an underwriter for an IPO, it is essential to evaluate their distribution capabilities, strategies and network.

Conclusion

Investment banks are expert facilitating a seamless IPO process and meeting regulatory requirements, thereby helping companies in issuing new stocks for the public at ease.

Thus, it is fair to state that several activities are facilitated by investment banks when a company issues new stocks to the public namely, creating a letter of intent, forming a bank syndicate, acting as financial advisors, managing roadshows, pricing the offering, working with legal counsels to evaluate bids, buy the whole offering and further sell it to investors and various other roles.

To learn more about how the stock market operates, where to invest, the role of investment banks, and other aspects of investing, connect with mastertrust.