However, you can free yourself from debt and take charge of your financial destiny with discipline, tenacity and careful planning.

In this blog, we will explore some of the best ways to free yourself from debt and pave the way for a brighter financial tomorrow.

What is a Debt?

A debt is an obligation or a financial liability that one party owes to another. It arises when one party (borrower) borrows money, goods, or services from another party (lender) and agrees to repay the borrowed amount along with any agreed-upon interest or fees within a specified period.

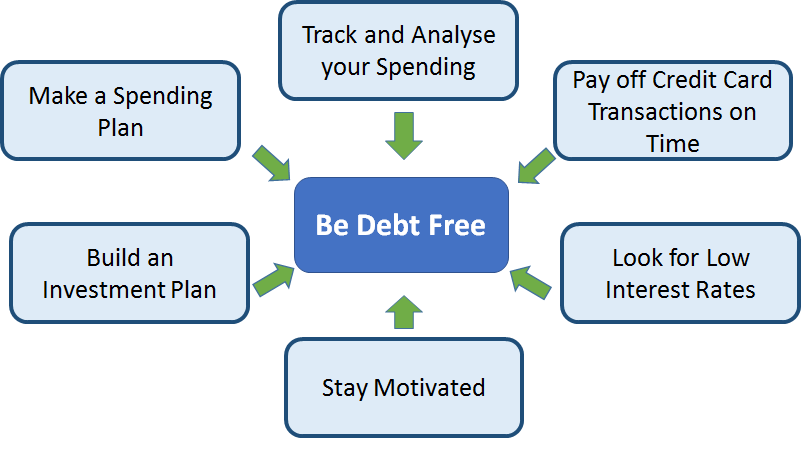

Best Ways to Free Yourself from Debt

Here are a few effective ways to free yourself from debt.

Have the Courage to Face Your Debt Head-On

To become debt-free, you must first face your financial realities. Collect all the details about your debt, such as the balances owed, the interest rates, and the minimum monthly payments. This information will help you understand the scope of your debt and allow you to create a strategy that will effectively deal with it.

Build a Budget and Stick to It

Developing a comprehensive budget is paramount to manage finances effectively. List all your income sources and categorize your expenses, ensuring that your essential needs are met while leaving room for debt repayment. By adhering to a budget, you'll gain better control over your spending habits and prevent further accumulation of debt.

Prioritize Debt Repayment Strategies

It's crucial to prioritize your repayment plans when you have several debts. The debt snowball and debt avalanche approaches are two popular strategies. In the debt snowball method, the lowest loan is paid off first, and then the next smallest obligation is paid off.

This strategy gives you a psychological lift as you watch your smaller debts quickly disappear. On the other hand, the debt avalanche strategy concentrates on paying off the debt with the highest interest rate first, which ultimately saves you more money. Select a plan that best suits your financial circumstances and level of comfort.

Negotiate with Creditors

Don't be afraid to negotiate with your creditors. If you're struggling to meet your debt obligations, reach out to them and explain your situation. They might be willing to offer you lower interest rates, extended repayment terms, or even settle for a lump-sum payment lower than the actual debt amount. Negotiating with creditors can help make your debt more manageable and pave the way for faster repayment.

Improve Your Income

Boosting your income can accelerate your journey to debt freedom. Consider taking up a part-time job, freelancing, or exploring other side hustles that can provide additional streams of income. Allocating this extra money towards your debt payments can significantly expedite the process of becoming debt-free.

Cut Irregular Expenses

Identify areas in your life where you can cut back on expenses. Evaluate your spending habits and distinguish between wants and needs. Eliminate non-essential expenses and redirect those funds towards your debt repayment. By making small sacrifices now, you'll be better positioned to achieve your long-term financial goals.

Create an Emergency Fund

Unexpected expenses can lead to further debt accumulation if you don't have a safety net. Building an emergency fund can act as a buffer, protecting you from taking on more debt when life throws a curveball. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

Get Professional Help

If you find yourself overwhelmed or unable to manage your debt on your own, consider seeking professional help from a financial advisor or a debt counsellor. These experts can provide personalized advice and guidance tailored to your unique financial situation.

Conclusion

Being debt-free involves dedication, self-control and tenacity. You will be well on your road to financial freedom by tackling your debt head-on, developing a budget, prioritizing repayment schemes, negotiating with creditors, increasing your income, decreasing needless costs, building an emergency fund and getting expert help when necessary.

As you progress towards a more stable and wealthy future, keep in mind that becoming debt-free is a journey. The day you become debt-free will be a day of great success and relief if you remain focused and dedicated.

mastertrust is one of India’s top-rated investment and stock brokerage platforms that offers several investment opportunities to users to earn a passive income. With mastertrust, you can invest in bonds, stocks, mutual funds, IPO, and much more.