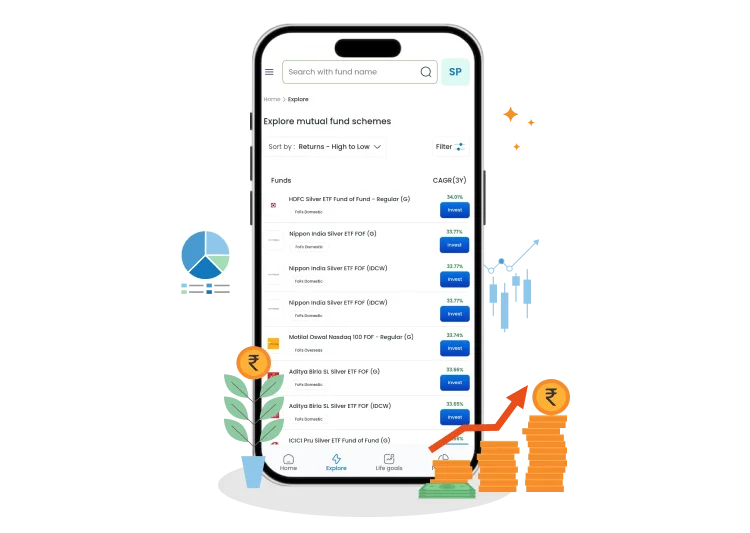

Comprehensive Wealth Management

Our Wealth Management Services stands out for its personalized strategies and blending expertise with technology. We help you succeed in your financial goals while maintaining a transparent approach by offering real-time insights and proactive risk management. At mastertrust, you get to experience a unique, client-centric service committed to your financial success.

Experienced Fund Managers

Client Centric

Integrity

Protective Solutions

Experienced Fund Managers

With a deep understanding of market dynamics, disciplined investment strategies, and a history of delivering consistent returns, our wealth management services play a pivotal role in guiding investment decisions, building investors’ confidence, and achieving long-term financial goals. By leveraging wealth management solutions, we ensure personalized strategies that meet the unique needs of each investor.

Elevate your derivative trading experience with precision, innovation, and expert insights

Advanced TradingView Charts offer comprehensive technical analysis tools and customizable indicators, empowering traders with in-depth market insights and precise decision-making capabilities.

Trading options directly from charts streamlines decision-making by allowing traders to visualize market data and execute trades seamlessly, enhancing efficiency and precision in options trading strategies.

Accessing over 100 built-in indicators and strategies on TradingView empowers traders with a diverse toolkit for technical analysis, offering a comprehensive range of tools to analyse market trends and make informed trading decisions.

Advanced option chains provide traders with detailed information on multiple strike prices, expiration dates, and option types in a single view, facilitating complex options strategies analysis and decision-making.

Brokerage Calculator

Diversified Approach

Transparency

Data Backed

Portfolio Review

Diversified Approach

By embracing diversification, mastertrust captures opportunities, mitigates volatility, and optimizes risk-adjusted returns. Using wealth management solutions & wealth and management strategies, it helps create a portfolio that weathers market fluctuations and ensures long-term financial success.