People save money for a variety of reasons as it provides financial security and freedom and also secures you in case any financial emergency arises. One can avoid debt, pay off loans, live their dream life and avoid further debt if they have saved a sufficient amount (which differs from each individual to other). The importance of savings cannot be denied, owing to the multiple benefits that it offers.

Savings are generally made by consuming less today so that one is able to consume more in the future. The importance of saving money has to be understood in depth because savings enable individuals to not be completely dependent on their monthly salary to sustain their current lifestyle and also to plan for their long term financial security.

Truthfully, there are several reasons why one must start savings as early as possible.

Let us discuss the top 5 reasons to emphasise on the benefits of saving money-

1. Long-Term Security

The future is uncertain and this signifies the importance of saving money even more. Savings bring along long-term security and it is said that the more you save, the more secure you will be. Without savings, one cannot handle the financial storms or emergencies that come during a lifetime. Also, with savings, one can think of various avenues of investments which can generate profits for them and from those profits, individuals can surely ensure long-term security.

2. Savings is a Step towards attaining Financial Freedom

Imagine giving yourself the freedom to do what you want, spend on what you desire and make more room for relaxation in your life! Well, all of this is possible with savings and thus the importance of saving money gains manifold importance. Without savings, one can feel stuck in a particular situation, if they highly rely on a pay check, but with savings, the scenario is totally different as funds for emergencies and contingencies are set aside.

3. Saving Money allows you to take Calculated Risks

If you set a savings goal and contribute regularly to your savings each month or at frequent intervals, you can explore a whole new range of opportunities. For example- trading in the stock market, starting a new business, funding an NGO etc. Thus, savings enable you to take calculated risks without relying heavily on a pay check. In other words, it allows you to have a greater sense of financial security and take calculated risks with the amount you have saved.

4. Savings Reduce Stress

Savings are surely one of the most important factors in leading a stress-free life. Knowing that you have gathered a certain amount of fund gives you a sense of relief and peace of mind. By saving money in a disciplined manner, your long-term and short-term goals can be achieved, you can plan your children’s education, take more care of your family, fund big purchases, prepare for unfortunate events and overcome most financial difficulties. Thus, one must be convinced that saving money is a primary goal that everyone must seek.

5. Savings allows to take benefits of compound interest

Among the various benefits of savings, one of the biggest benefits is that it allows individuals to utilise the power of compound interest. Thus, if you start saving now and invest it in the right avenues, you can start seeing impressive results. Compound interest takestime to show its magic. Hence, one needs to give time to savings and see them grow over time. In fact, with the power of compounding, people have created wealth and this intensifies the importance of savings.

Suggested Read:The Importance of an Emergency Fund | mastertrust

Conclusion

While there are countless reasons to save, one of the most important one is creation of wealth. Moreover, the Financial Independence and Financial Freedom that comes along with savings is truly limitless. It actually depends on the amount of savings that one has managed to gather in their lifetime. There are several methods to enable savings like practicing financial discipline, avoiding unnecessary expenses, limiting your credit card usage, creating a budget and investing in various tools.

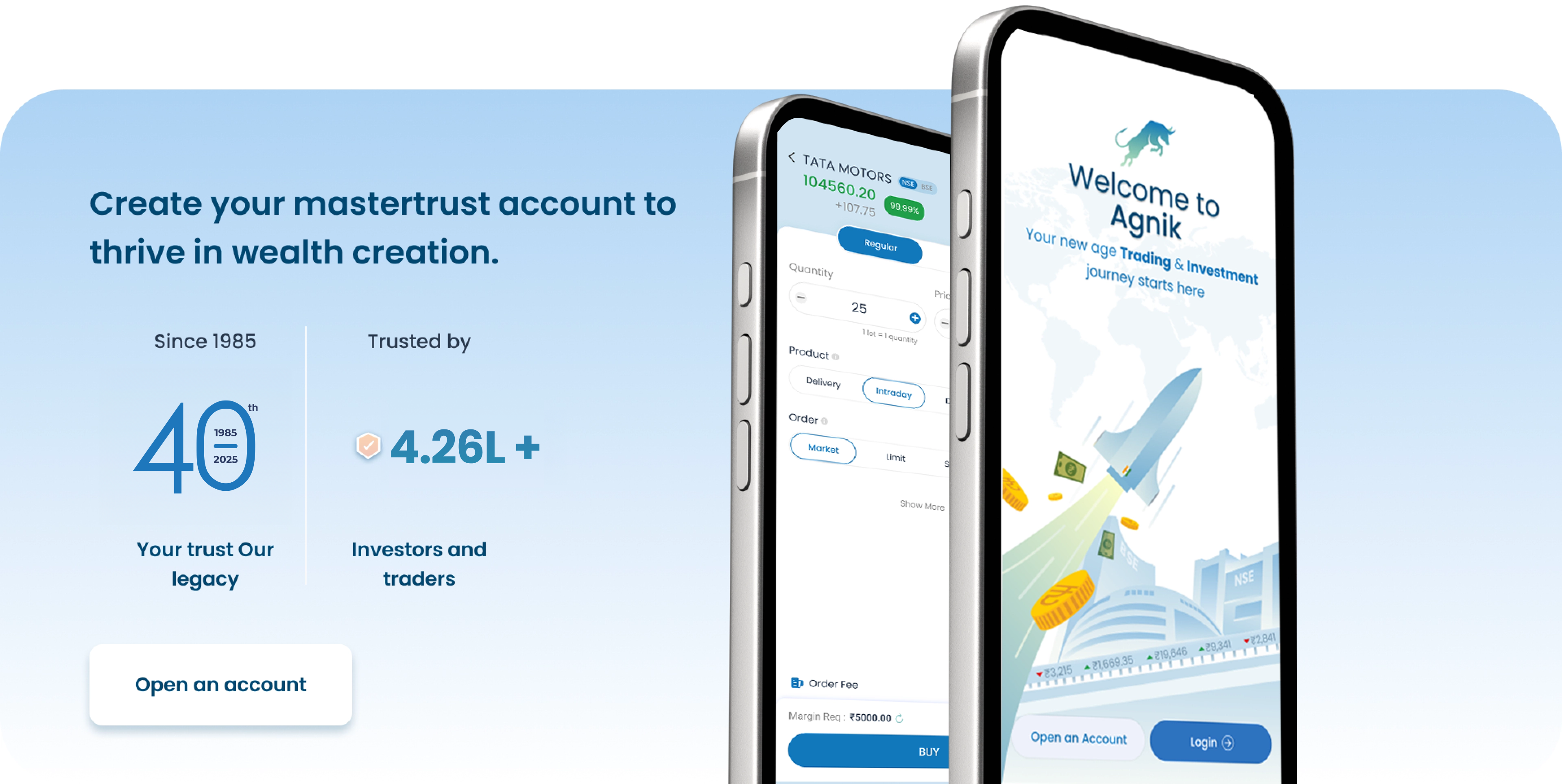

To learn more about Savings and Investments, connect with mastertrust today! We help you achieve your life goals through the expertise of our finance professionals who guide you on the right path of investments.

FAQ

What is savings and its importance?

Saving is crucial for securing financial well-being, achieving long-term goals, and ensuring peace of mind. As the saying goes, ‘Don’t save what is left after spending, spend what is left after saving.

What are the three reasons for saving?

Saving is an important habit to get into for a number of reasons — it helps you cover future expenses, manage financial stress and plan for vacations.

What is the golden rule of saving money?

A widely recognized golden rule of saving in personal finance is the 50/30/20 rule, which divides after-tax income into three parts: 50% for needs (housing, utilities, food), 30% for wants (entertainment, dining out), and 20% for savings and debt repayment. Another key principle is to ‘pay yourself first,’ meaning you set aside a portion of your income for savings before covering any other expenses.