The Coronavirus pandemic has caused a deep crack in financial markets globally and stock markets have suffered huge losses. Stock market corrections have led to investors losing a lot of money in their investment portfolios and although in the last some days equity markets have seen some major pull backs, the volatility around these wild rotations have confused the investors as to what their investment strategy should be going forward. Given the turbulence, the most common question that comes to an investor’s mind is that whether he should exit now and minimize losses or stay put, and most often, in the absence of knowledgeable advice, investors make mistakes that are unfavorable to their investment plans of long-term wealth creation.

Common Mistakes

Panic Selling

The most common hypothesis in the equity markets to generate optimal returns is to predict the bottom and tops and sell or buy accordingly. However, in reality, even the most talented fund managers are unable to do so; at best their goal is to exit as close to the top as one predictably can and to enter into new positions closer to the bottom. The real-life result for the common investor is exactly the opposite, retail investors have a propensity to enter the stock markets at their peaks and exit when the so-called elusive bottom is near. In times of sharp market corrections, it is widely seen that investors run out of patience and often panic and in desperation sell off all their holdings and book their losses. This is the worst thing one can do to their investment portfolio and should be avoided at all costs; time to re-evaluate one’s portfolio and to look at each and every stock objectively is at the time of market correction. Fundamentally strong stocks in an investment portfolio should never be liquidated but market correction is rather an opportunity to average down and accumulate good quality stocks.

Changing Investment Strategy

Investors should not get distracted by market volatility and try to charter on a new path and try out a new investment strategy. A common mistake that investors make during market corrections is just because they have lost significant value they jump into bad quality stocks. Rather than buying a stock just because it looks cheap, one should analyze the reasons behind the steep decline and buy only if the decline in unjustifiable. Another mistake that investors make during downturns is by getting extremely cautious and liquidating stocks with high return potentials and getting into safer names which are unable to generate higher returns in the long term. In other instances, investors who otherwise have a longer-term outlook on the stock markets turn into day traders in an attempt to capitalize on market volatility but eventually get sucked into the volatility vortex and incur huge losses in the process. The bottom-line therefore is that one should always stick to their investment strategy which is tailored to individual risk tolerance, market corrections are opportunities to rejig and rebalance rather than making wholesale changes into one’s investment portfolio.

What can you do better?

Stick to Fundamentals And Stay For Long-Term

While unlike the past market crashes, economy is not the root of the current crash, the short term wealth destruction will play out exactly the same way it has played out in previous crises. In bad times, typically fundamentally strong businesses sail through and reach the shore safely, while weaker businesses sink. Better run companies will be able to survive the turbulence and bounce back quickly; therefore, in turbulent times it makes more sense to stick with proven and fundamentally strong businesses.

|

Previous Market Crisis

|

2000

|

2008

|

|

Start Date

|

11-Feb-00

|

08-Jan-08

|

|

End Date

|

18-Oct-00

|

09-Mar-09

|

|

Decline

|

-39.40%

|

-60.90%

|

|

No. of trading days

|

171

|

286

|

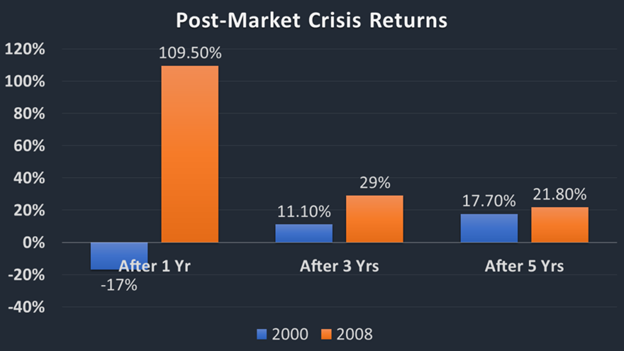

Investing should be for the long term and one should not react based on one-week, one-month or one-quarter performance. For instance, between May 2008 and February 2009, the S&P 500 lost nearly half of its value, but within one year it bounced back, consequently leading to significant returns to the investors who stayed invested or made fresh investments during the crisis. In the five years after that the S&P 500 climbed more than 153 percent.

The following graphics depict the two major stock market corrections and the returns post crisis

The key is to stay invested with a long-term horizon into quality names with strong fundamentals because these stocks are the real wealth creators for the investors.

If You Have Cash, It’s Best Time to Invest in Equity Markets, But Don’t Try to Catch Market Bottom

Equity markets offer superlative returns across asset classes in the long term, therefore if one has some available liquidity, this is not the time to invest fresh capital into other asset classes. Other asset classes such as gold, real estate although would act as a hedge in the short term but as the market is currently trading at a discount, would not be able to match the returns of the equity markets. If you are already invested, this would perhaps be the right time to deploy fresh capital in good quality stocks or average down into fundamentally strong positions. This is the time to deploy a lump sum in phases in addition to any other systematic investment plan (SIP) into equity markets that one may already have. Do not commit your cash in one go, rather a staggered entry which is spread over several months is ideal. In doing that, you may not be able to capture the swing in its entirety, but will certainly avoid getting whipsawed by sucker rallies. The key to success remains in investing small chunks at regular intervals and avoiding the desire to catch a bottom and thus failing to deploy fresh capital altogether.

Ignore Short-Term Volatility and Don’t Review Portfolio Every Day:

At times of market turmoil and volatility, looking at your portfolio performances daily may be potentially detrimental to your investment portfolio. Liquidating significant portions of your investment portfolio by panicking over your unrecognized losses could lead to irreparable losses. Checking your portfolio on a daily basis will lead you to question your investing choices that could result in you making totally unnecessary investment choices. Any review you undertake at this stage should be purely from an asset allocation perspective. If the asset mix has changed substantially from desired levels, rebalance portfolio to its original shape, leave the in-detail review for a later time.

Conclusion

Investors should review the listed mistakes and refrain from making them; market corrections are best times to capitalize on opportunities that could lead to significant wealth creation in the long run. Investors should leverage this opportunity by either averaging down into quality names or deploying fresh capital to good quality stocks that have been beaten down due to the market turmoil.